Pv of future cash flows calculator

We can ignore PMT for simplicitys sake. Assume that youre given a choice of 3000 in cash today or 3300 one year from today.

Calculate Npv In Excel Net Present Value Formula Excel Excel Hacks Formula

To identify your best option you must either calculate the present value of 3300 or the.

. Present Value is calculated using the formula given below. The answer tells us that receiving 10000 five years from today is the. 5500 on the current interest rate and then compare it with Rs.

In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. The present value PV formula discounts the future value FV of a cash flow received in the future to the estimated amount it would be worth today given its. Investment Calculator Future Value Calculator Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the.

Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. Try our calculator and see what selling your annuity or structured settlement could get you in cash today. It is possible to use the calculator to learn this concept.

PV CF 1 r t. This Calculator calculates present value of an amount receivable at a future date at any desired discount rate. Nitin Grover Co.

In order to find out the present value of uneven cash flows put your values in the following formula. The NPV calculator gives you information on the present value of future cash flows. Pressing calculate will result in an FV of 1060.

A plan that allows employees to donate unused sick-leave time to a charitable pool from which employees who need more sick leave than they are normally. Present Value PV Calculator For Future Cash Flow. Calculate the present value of all the future cash flows starting from the end of the current year.

This is a special instance of a present. Has been combining the wisdom from a huge experience-base and converting that into benefit for its clients. Present Value PV Formula.

To learn more about or do. Input 10 PV at 6 IY for 1 year N. The present value can be calculated at the chosen discount rate for any odd.

CF for Year 1 1 r 1 CF for Year 2 1 r 2 CF for Year 3 1 r 3.

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Time Value Of Money How To Calculate The Pv And Fv Of Money Time Value Of Money Cash Flow Statement Financial Statement Analysis

Time Value Of Money How To Calculate The Pv And Fv Of Money Time Value Of Money Cash Flow Statement Budget Forecasting

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

Present Value Pmp Exam How To Memorize Things Pmp Exam Prep

Npv Calculator Calculate And Learn About Discounted Cash Flows Investing Money Investing Best Money Saving Tips

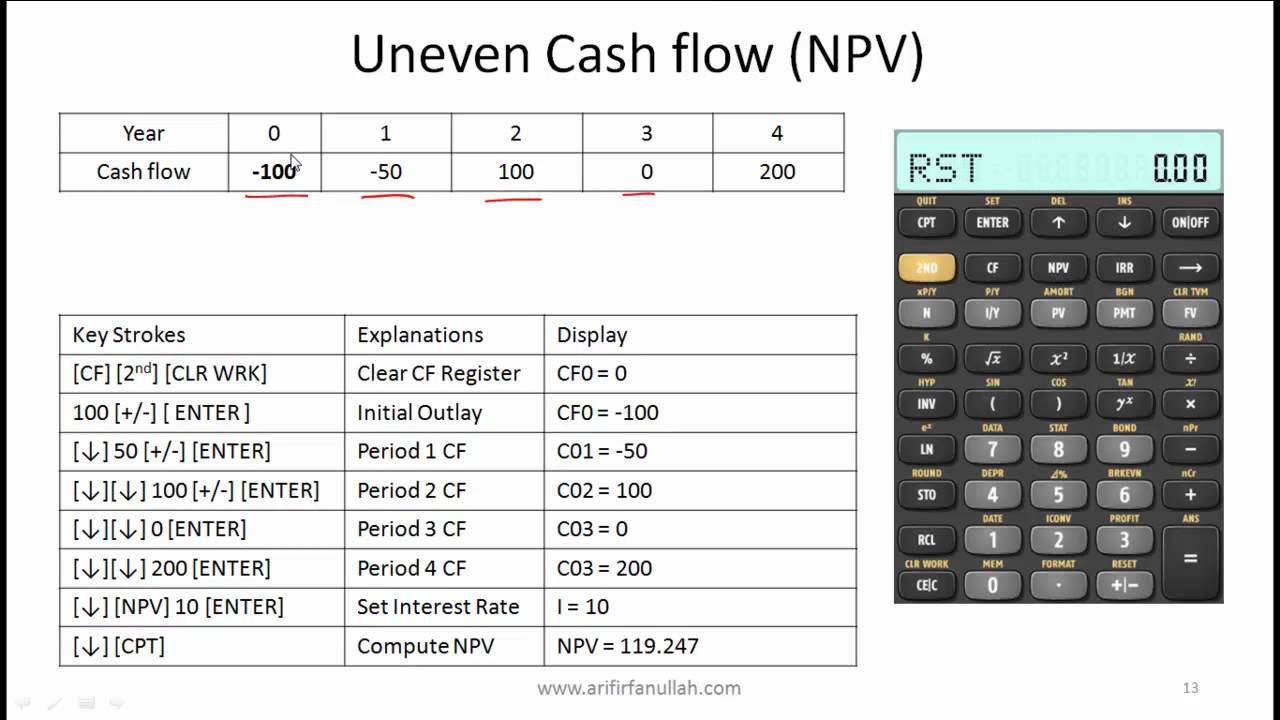

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Present Value Pmp Exam How To Memorize Things Pmp Exam Prep

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

How To Calculate Irr Internal Rate Of Return In Excel 9 Easy Ways In 2022 Excel Calculator Cash Flow

Present Value Table Meaning Important How To Use It Managing Your Money How To Raise Money Skills To Learn

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Annuity Calculator Present Value Of Annuity Annuity Calculator Annuity Investment Advice

Fv Function Learning Microsoft Excel Excel Templates

In This Article We Are Discussing Discounted Cash Flow Analysis By Giving A Real Time Example Of A Company Lets Learn Its Components Cal Cash Flow Flow Cash

Cash Flow Basics How To Manage Analyze And Report Cash Flow Cash Flow Statement Positive Cash Flow Cash Flow

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis